Knowing the number of payers that providers contract with is important for a few reasons.

Reason 1: It is a proxy for administrative burden. The number of contracts can be a useful proxy for the administrative burden that multiplies as a provider contracts with more payers. This includes such tasks such as enrollment, credentialing, contracting, ongoing demographic updates, and network education. As the number of contracts increases, the cost to perform these tasks rises. Knowing the number of contractual relationships for different types of providers can be helpful for solution vendors looking to size the market for streamlining those administrative tasks. The information is also useful for regulators interested in reducing administrative burden or who want to be mindful of regulatory impact and minimizing unintended increases in burden that new regs may cause.

Reason 2: It can be a factor of patient access. If a provider has a larger set of payer relationships than others, then more members will have ‘covered’ access to that provider. Zooming out, total payer contracts can be useful to assess patient access to care within the same geography. For example, knowing the behavioral health providers within a geography and the insurances they accept and knowing the proportion of the county population covered by those insurances can be an indicator of the level of mental care access that patients have. Since payer concentration varies by geography, and some payers constitute a larger proportion of members than others, one would need to use the number of payer contracts in conjunction with payer mix and member enrollment to assess ‘covered’ patient access to specific types of care

Previous analysis on the average number of payer contracts per provider

Two studies were discovered as part of a literature search on the number of payer contracts per provider. A 2013 Massachusetts General Hospital and Columbia University study published in the Journal of General Internal Medicine found that the average provider had 12 managed care contracts. A 2019 provider survey by CAQH found that the average physician practice had 20.2 health plan contracts. The earlier study was based off data between 1996 and 2005, which was prior to the enactment of the Affordable Care Act. ACA may have contributed to the increase in average contracts as providers sought to establish contracts with payers covering newly insured patients.

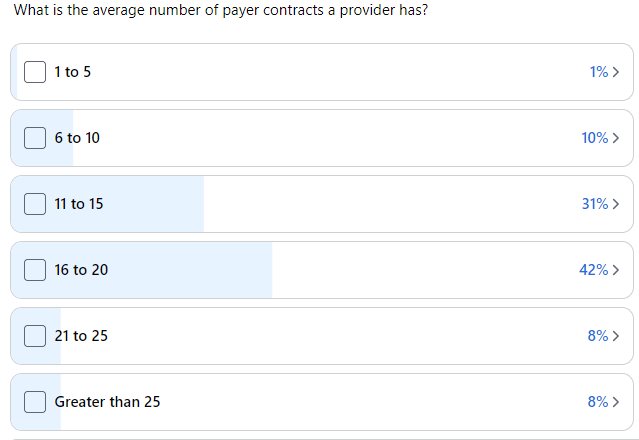

Defacto Health conducted a survey in April 2023 on the Credentialing Collaboration Group, the largest online network of credentialing professionals. These professionals manage credentialing and payer enrollment in-house for practices and health systems, and through third-party vendors. We posed the question ‘What is the average number of payer contracts a provider has?’ and received total of 57 responses revealing that the average was estimated between 16 and 20 payer contracts per provider (depending on where you anchor the average value of ‘greater than 25’). We received one comment from a responder saying that they were responsible for a telehealth practice that had providers ‘licensed in tons of states’ and contracted with 78 payers, so other responders may have significantly higher than 25 payer contracts.

Using API-sourced data to assess average payer contracts per provider

Defacto Health sources data from APIs and machine readable files from 108 payers nationwide. We wanted to see if we could use this data to calculate the number of payer contracts that providers have. We leveraged data on over 2.5M healthcare practitioners in the data set, and used the PractitionerRole FHIR entity as a proxy for a contract (i.e., practitioners can have multiple TIN affiliations and via each affiliation can contract separately with a payer). We counted the number of PractitionerRoles each Practitioner has across all integrated payers. Finally, we applied a multiplier of 15% to account for carriers that we have not yet integrated.

We found that the average practitioner has 19.2 payer contracts. This is within a reasonable range of both the CAQH number (which focused on just physicians) and the statistic from the April 2023 survey (across all provider types, which is how we also conducted the assessment using the payer-sourced data set). We then applied the same approach to calculate average payer contracts for specific taxonomy groupings (we used the NUCC groupings of taxonomy codes which categorizes most contracted practitioner types). See Figure 1 below:

Fig 1. Average Number of Payer Contracts by Provider Grouping

| Provider Grouping | Total Providers | Average Number of Payer Contracts |

| Allopathic & Osteopathic Physicians | 1,094,710 | 26.03 |

| Behavioral Health & Social Service Providers | 500,991 | 7.06 |

| Chiropractic Providers | 67,060 | 7.12 |

| Dental Providers | 212,090 | 41.46 |

| Dietary & Nutritional Service Providers | 21,005 | 7.05 |

| Eye and Vision Services Providers | 61,346 | 32.88 |

| Nursing Service Providers | 38,245 | 12.99 |

| Physician Assistants & Advanced Practice Nursing Providers | 560,771 | 14.46 |

| Pharmacy Service Providers | 19,277 | 1.91 |

| Podiatric Medicine & Surgery Service Providers | 17,336 | 22.67 |

| Respiratory Developmental Rehabilitative and Restorative Service Providers | 182,054 | 8.20 |

| Speech Language and Hearing Service Providers | 72,274 | 5.35 |

| Student Health Care | 41,404 | 5.13 |

Physicians, dental providers, vision providers, and podiatrists lead other categories in terms of largest average number of payer contracts. Vision and dental providers contract with specialty plans as well as medical plans, which can explain why their contract counts are relatively high versus physicians. Behavioral health lags with an average number of contracts at 7.06. Comparing the average statistic for physicians 26.03 with the 2019 CAQH number of 20 in 2019, a probable reason for an increase is the adoption of virtual care (and multi-state licensing) during the COVID-19 pandemic among physicians. Physicians who practice virtually, and across state lines, are likely to seek enrollment with a greater number of payers.

Have ideas on how to splice the data, or other questions you’d like to answer? Let us know, and we’ll be in touch.